10 Reason to Buy into Iskandar Malaysia

Iskandar Malaysia officially launched in 2006, covers an area of 2,217 square kilometers (roughly three times the size of Singapore).

Upon launch, its total population was 1,350,000 of which the total workforce was 610,000. As at December 2014, the population of Iskandar Malaysia stood at 1,880,000 of which 750,000 was the total workforce.

The 10 reasons to buy the Iskandar Malaysia – Economic Development Idea

1.GOOD PLANNING

The CDP has been defining all the possible aspects of the Regional Development and acts as master-plan of the whole Iskandar Malaysia. The manufacturing and services sectors are the drivers justifying the population growth projection (3,000,000 by 2025 with a workforce of 1,500,000). Besides this, the CDP provided a complete study on existing and planned infrastructures that will be necessary to satisfy the needs of a doubled population.

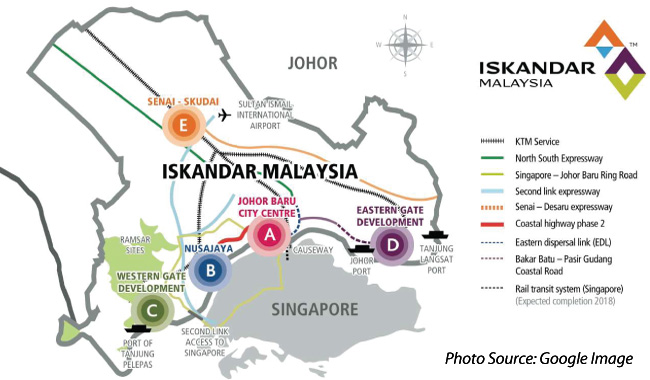

Water reticulation, power supply, highway, expressways, railways with planned MRT, LRT and monorail, just to mention the main works, had been properly planned and partially executed. EDL and the Senai-Desaru Highway are only two of the many public works already completed and in use. In June 2015, a first revision of the original CDP has been presented to the public showing how much authorities are keeping their eyes open on what is happening in Iskandar Malaysia!

The CDP2 emphasizes on the economic and social development of the region relying on these to achieve the set population growth by 2025: 3,000,000 Iskandarians.

2.ECOMONIC GROWTH

Economic development has been given the priority as without FDI and local manufacturing/services investment there cannot be any future development of the region.

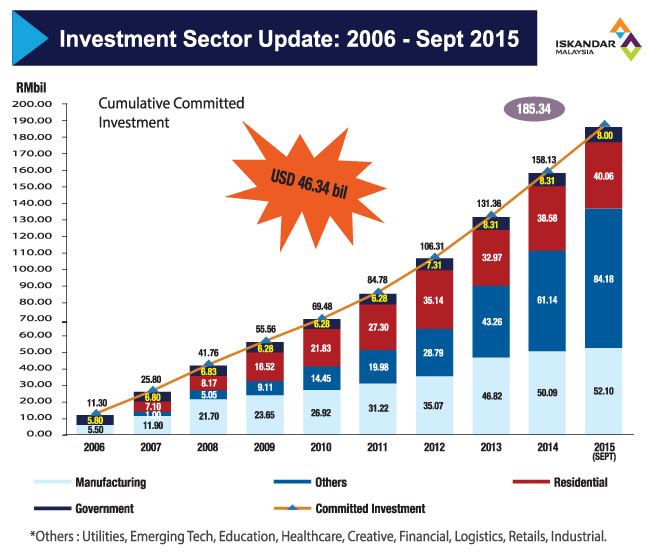

Iskandar Regional Development Authority (IRDA) had recorded total cumulative committed investments of RM172.51 billion from 2006 until June 2015. Of this total, over 50% or RM87.80 billion represent investments that have been realized.

Interestingly, out of the total only RM8.31 billion or 5% represents public investments. This underlines how much the private sector believes in Iskandar Malaysia. Same goes for residential properties which consist of less than 24% of the total, highlighting the sustainability of the whole region.

3.DIFFERENTIATED ECONOMIC CLUSTERS

The nine pre-defined economic clusters; Electrical & Electronics, O&G, Food & Agro Processing, Logistic, Education, Financial, Tourism, Health and Creative Industries have attracted local and international corporations in the region boosting the growth factor of Iskandar Malaysia.

More than 20 Universities have planned their Malaysian campuses a stone’s throw away from Medini and some of them have already started accepting student registrations. Pinewood Iskandar Malaysia Studios has been officially opened last year and has received a great favor from the international movie industry, using it as their movie set.

A good number of new industrial parks have been successfully completed and occupied by Malaysian and Singaporean SMEs and more are in the pipeline giving long term sustainability to the regional development.

4.INFRASTRUCTURE WORKS DONE

Federal and State Government and authorities have been completing a general improvement and upgrading of all the infrastructures (road, water reticulation, power distribution and so on) before the actual property development even started.

On top of the already planned infrastructures during the last two years we have seen a number of important announcements about the High-Speed Rail JB to KL (HSR) which is now under finalization alignment and stations wise and more recently the third link or “friendship bridge” that has been brought up during the last official visit of the Singaporean PM to Malaysia.

Realizing the importance of public transportation in an important economic area as Iskandar Malaysia, this year an approved alignment of three BRT (Bus Rapid Transit) lines have been presented to the public for commenting and is now with the authorities for definitive planning and execution.

5.SINGAPORE BOOST FOR ISKANDAR MALAYSIA

Due to stringent land policies in Singapore, industrial developments are normally on a non-renewable 30-year lease. The City State’s SMEs are now looking with deep interest into a possible expansion for their manufacturing sectors and Iskandar Malaysia is the perfect location for it.

Drivers for the Singaporean decision to invest in Iskandar Malaysia are: freehold properties, low cost of industrial space either leased or built, low cost of labor, low cost of properties in general, ease of accessibility by road (two bridges are offering alternative routes to access Iskandar Malaysia), friendly “doing business” environment and willingness to improve on the Malaysian side.

6.WIDE AND DIVERSIFIED INVESTOR BASE

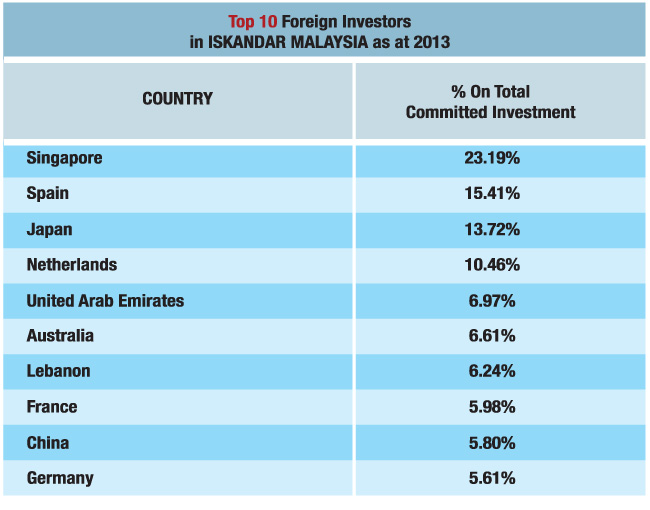

Even though Singapore can be looked at as one of the main drivers for the Iskandar Malaysia economic development success, local investment is still representing the greatest part (61%) of the total RM 172.51 billion of total cumulative committed investment as at June 2015. Out of the top 10 foreigner countries investing in Iskandar Malaysia, Singapore represents 8.5% of the total cumulative committed investment giving high sustainability based on a highly diversified investors’ base.

7.MOVING TOWARDS HIGH-INCOME ENVIRONMENT

Malaysia’s gross domestic product (GDP) per capita in 2014 exceeded the average of all countries worldwide for the first time. Malaysia’s GDP per capita was at US$10,830 (RM47,600) in 2014.

Johor experienced one of the highest increase in per capita income compared to the rest of Malaysia. This is raising the average value of affordable housing in Johor by a good 25%. This rapid growth will boost the development of shopping malls, retail areas and commercial space which will expand at a much greater pace.

A higher per capita environment will generate a very interesting yield for experienced and new investors. Not to mention the positive impact on property prices.

8.FREEHOLD PROPERTIES FOR FOREIGNERS

Malaysia is the only country in the whole SEA region where foreigners are allowed to buy freehold real estate properties (residential, commercial, industrial and land) without particular restrictions (currently there is only a RM1,000,000 threshold and a consent letter to be released by the local authorities).

9.COMPETITIVENESS OF PROPERTY PRICES

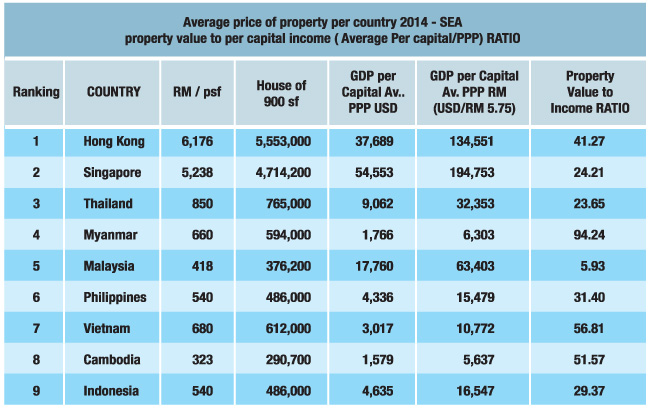

Even though valid for Malaysia as a whole, we are still the country where properties are having the lowest cost compared to all our regional neighbors.

By comparing the ratio between average per-capita income with average property price of all our regional neighbors, Malaysia clearly has the advantage. We are looking at a positive outlook in terms of appreciation.

10.UNMATCHED HOUSING DEMAND

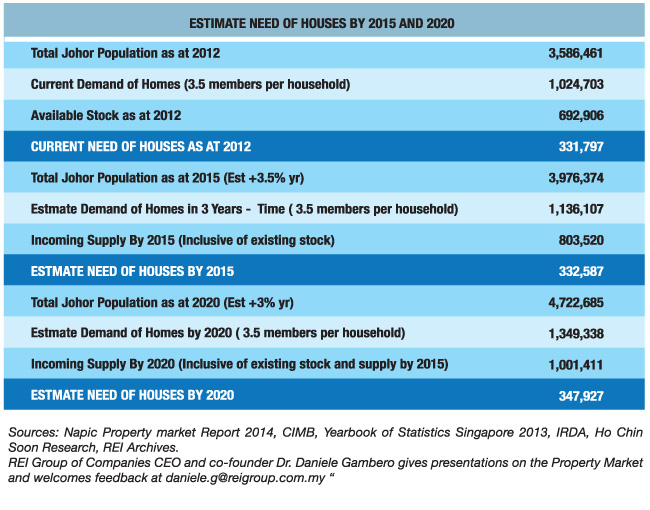

Iskandar Malaysia is a region of whereby the current demand of residential properties lacks adequate offer. This provides a higher capital gain potential in the short term if compared to other Malaysian states where demand and offer are more balanced. A very good plus factor which can be found in Iskandar Malaysia is a balanced offer of affordable housing with values at psf of RM250 to RM600 and high-end properties offered in good quantity for both direct and investment use.

The coastal areas comprising the second link, the Causeway and the eastern side of Johor Bahru are currently offering investment products starting from RM500-RM600 and up to RM1,600 psf, while more affordable units can be found in the whole northern corridor comprising Kulai, Senai, Tebrau down to Pasir Gudang.

The chart shows how sustainable the demand will be for the next five years and leaves us with a clear view on the possible capital appreciation and ROI we may enjoy.

No Comment